Ready to Master the Art of Persuasive Communication? Unlock Your Success Today!

This post covers everything you need to know about legal mortgage

Before the bank advance a loan to the borrower, bank, the bank will often need security for the loan it offers.

The most preferred form of security is the mortgage.

There are two kinds of mortgage i.e. legal mortgage and equitable mortgage.

However, the focus here will be on discussing;

Transform Your Communication, Elevate Your Career!

Ready to take your professional communication skills to new heights? Dive into the world of persuasive business correspondence with my latest book, “From Pen to Profit: The Ultimate Guide to Crafting Persuasive Business Correspondence.”

What You’ll Gain:

Let’s get started

Read Also:

Jump to section

A legal mortgage is a type of mortgage which is created by the execution of a deed known as a Mortgage Deed.

The Customer/ mortgagor binds himself to repay the mortgage money on a certain date and transfers his interests in mortgaged property absolutely to the banker on terms that the mortgagee/banker will transfer it to him on repayment of the mortgage money.

The customer has the right to redeem his property not only in the absence of default of payment but also in the default of payment provided that he can pay up the amount due before his right is debarred.

In a mortgage transaction, the banker becomes a mortgagee who is a creditor having a lien or charge on land for his dept, with or without the right of possession and the customer becomes a mortgagor who transfers an interest in a specific immovable property by creating a mortgage.

Therefore, the relationship between a banker as mortgagee and his customer as mortgagor is established when the latter executes a mortgage deed in respect of his immovable property in favor of the bank or deposits the title deeds of his property with the bank to create a mortgage as security for the load advance.

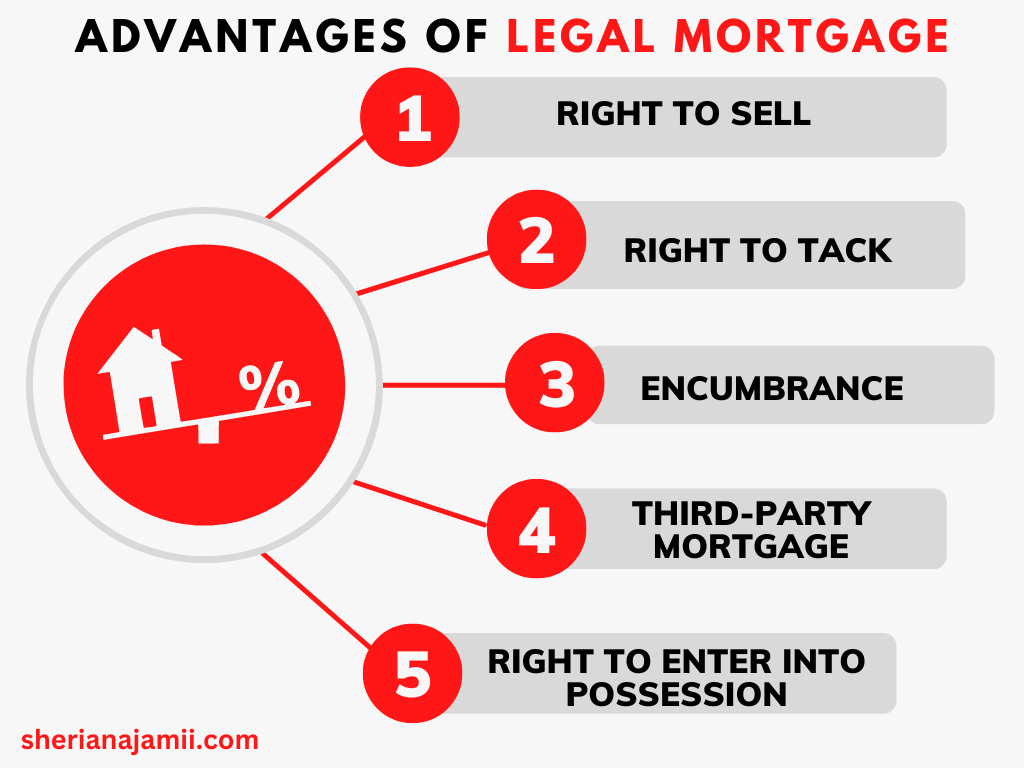

The following are the advantages of a legal mortgage

Failure of a mortgagee to register a legal mortgage of registered land will render such a mortgage ineffectual to create, transfer, vary or extinguish any estate or interest in any registered land.

In Guaranty Discount Co v Credit Finance Ltd [1963] EA 345 was held that failure to register a legal mortgage renders it void.

Under a legal mortgage, a mortgagee can lose all remedies available to him in case of default by the mortgagor, if the mortgagee fails to follow proper procedure in the creation of the mortgage.

If the mortgagee will make an improper evaluation of a mortgaged property this will create a problem of obtaining a reasonable price when the mortgagor default and the mortgagee choose to sell the mortgaged property.

Also, contradictions may arise when a mortgagee will not carry physical verification of the property as a matter of experience so as to verify whether a customer has a spouse and whether the land to be mortgaged is a matrimonial home or not.

As was in the case of Zakaria Barie Bura v Theresa Maria John Mubiru [1995] TLR 211 was a case involving a house jointly owned by the spouses.

In an action by the wife for a declaration that the sale of the house by the husband without her consent was void, the court held that the husband had no power to sell the mortgaged house because it was jointly owned by the two spouses.

The legal mortgage is still the best form of the mortgage due to the following reasons.

A legal mortgage gives the customer the right to redeem his property not only in the absence of default but also in default provided he can pay up the amount due before his right is debarred.

This right is known as the equity of redemption also known as the right of redemption.

It exists as soon as a mortgage is created.

Therefore banker keeps the mortgaged land with the customer’s right of redemption upon payment.

A legal mortgage allows a customer to mortgage an immovable property to more than one banker, it should be noted that the mortgage is not of the land but his interest in the land. With such power, customers can create more than one mortgage with different bankers.

For example, if a customer owns a landed property worth a hundred million dollars, he can use the same property to create a mortgage with different banks, and this will depend on the amount of loan I seek.

A legal mortgage is more formal. The law offers protection to the customers in case he defaults.

For example, the banker cannot exercise the right to sell without complying with the procedure prescribed by the law and in case the sale was properly conducted the banker has to refund the amount which is exceeded after taking the owed money.

a legal mortgage allows the customer to create a third-party mortgage in case a customer needs a loan but does don’t own an immovable property to secure it.

Through the third part mortgage, a customer will be able to use the property of another person with his consent to get a loan from a bank.