Ready to Master the Art of Persuasive Communication? Unlock Your Success Today!

This post covers the functions of banks.

here you will learn

let’s get started

Jump to section

Transform Your Communication, Elevate Your Career!

Ready to take your professional communication skills to new heights? Dive into the world of persuasive business correspondence with my latest book, “From Pen to Profit: The Ultimate Guide to Crafting Persuasive Business Correspondence.”

What You’ll Gain:

Bank can simply be defined as an entity that is engaged in the banking business.

However In the case of United Dominions Trust Ltd V. Kirkwood bank is defined to mean cooperation that accepts money on current, accounts, and paycheques to drown upon such accounts on demand and collect cheques for customers.

Read also: History of banking

Generally, there are two major types of banks i.e Central banks and Commercial Banks.

It is true that a bank is a place where people keep their money.

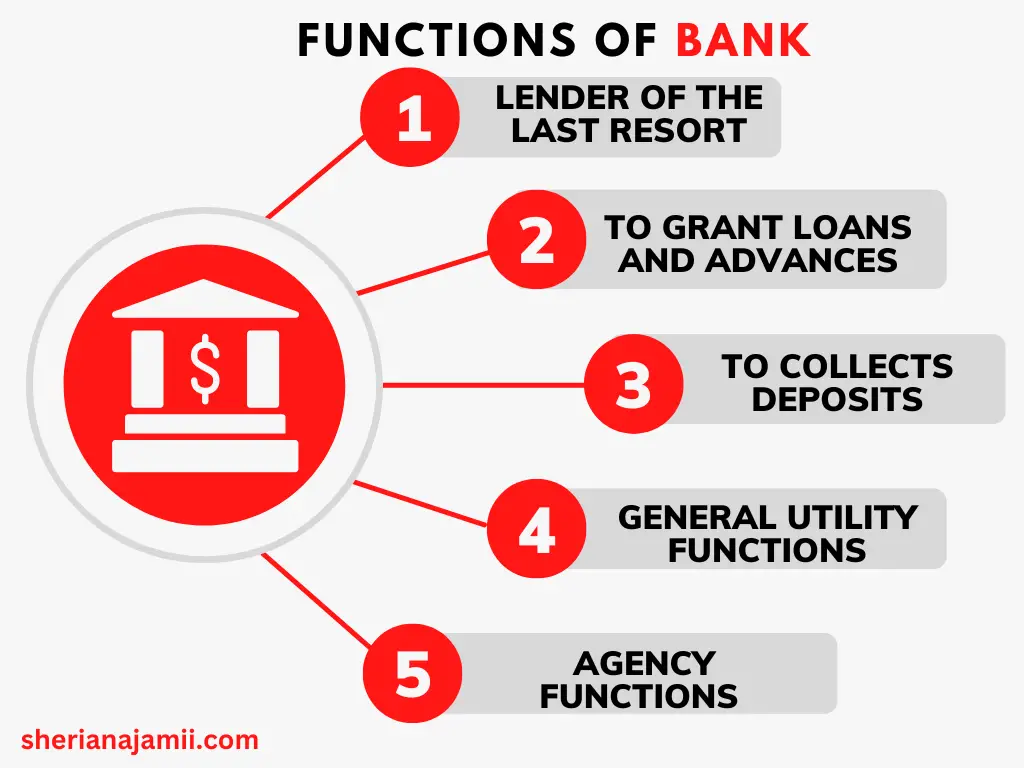

However, it will be wrong for us to confine ourselves to that view because apart from that there are a lot more functions that banks can perform.

Here the functions of the bank are divided according to the types;

There is no single definition of what is a Central Bank; a Central Bank can well be defined based on its functions. The following are the functions of a Central Bank.

Commercial Banks are all banks that are engaged in functions that are distinct from the functions of the central bank. The major aim of commercial banks is to generate profit for their shareholders.

Commercial banks perform both primary functions (banking services) and secondary functions (non-banking services)

Primary functions of commercial are those functions that are strictly banking services and can be done by the bank only and not other financial institutions.

The primary Functions of commercial banks include;

Secondary functions of commercial banks are those functions that are non-banking services that can also be done by other financial institutions.

The common secondary functions of commercial banks are agency functions and general utility functions.

Commercial banks perform the following agency functions.

Ellinger & Lomnicker(1994) “Modern banking law”; 2nd ed Publ. info. – Oxford: Clarendon Press,

Hapgood, M.(2007), Paget’s Law of Banking, 13th ed; Lexis Nexis Butterworths, London

Khubchandan, B.S(2007), Practice & Law of Banking for Macmillan India Ltd, New Delhi.