Ready to Master the Art of Persuasive Communication? Unlock Your Success Today!

This post covers everthing you need to know about tax avoidance and tax evasion

Tax avoidance and tax evasion are popular complex concepts when it comes to tax issues.

Here i will take you through

Let get started!

Transform Your Communication, Elevate Your Career!

Ready to take your professional communication skills to new heights? Dive into the world of persuasive business correspondence with my latest book, “From Pen to Profit: The Ultimate Guide to Crafting Persuasive Business Correspondence.”

What You’ll Gain:

Jump to section

Tax avoidance is the practice and the technique whereby one so arranges his business affairs such that he pays little or no tax at all but without contravention of the tax laws.

Tax avoidance takes advantage of any loopholes and weaknesses, deficiencies, and loose or vague clauses in the tax legislation to minimize or eliminate tax liability altogether.

Tax avoidance is not punishable by law.

Where the tax authorities detect the practice, the only solution is to amend the law in order to plug the loopholes.

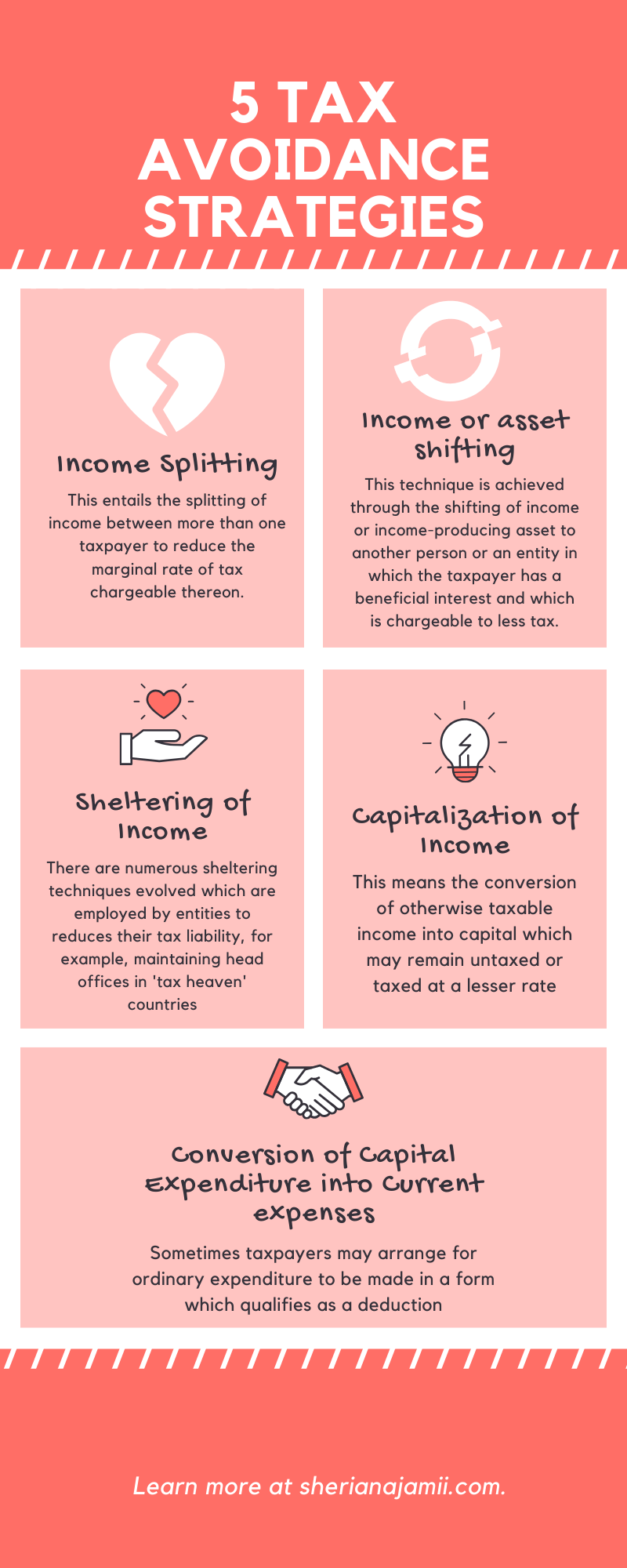

The following are the methods of Tax avoidance

This entails the splitting of income between more than one taxpayer to reduce the marginal rate of tax chargeable thereon.

Example tax law may provide for taxable income for individuals in the manner that an individual with less than 1.2m Tsh (the figure is only an example) income per year should not pay tax, with income splitting an individual makes sure that he split his or her income so as his/her income not to reach that amount so as to avoid tax.

This technique is achieved through the shifting of income or income-producing assets to another person or an entity in which the taxpayer has a beneficial interest and which is chargeable to less tax.

For example The use of devices such as issuing loans or in dealing with assets, dispose of them by way of non-taxable dispositions.

This technique involves the use of devices such as issuing loans or in dealing with assets, dispose of them by way of non-taxable dispositions, to effect deferral until sometime in the future, the payment of tax on income currently being earned.

There are numerous sheltering techniques evolved which are employed by entities to reduces their tax liability, for example, maintaining head offices in ‘tax heaven’ countries, using domestic tax schemes to the maximum extent by taking deduction which is generally available to mining and agricultural sectors, investment allowances.

This means the conversion of otherwise taxable income into capital which may remain untaxed or taxed at a lesser rate, Or conversion into some form of intangible the benefit to the recipient, the receipt of which will be untaxed, Or conversion into some form of income otherwise exempt from tax by the provisions of the Tax Act.

For example, letting the property on lease at a large premium and much-reduced rent.

Sometimes taxpayers may arrange for ordinary expenditure to be made in a form that qualifies as a deduction. For example, an arrangement made by the company to allow the Director to go on a business trip with family is, in fact, a vacation.

There are different techniques that reduce the amount of dividend thereby that tax liability will reduce.

For example, a solvent company is bought by a shareholding Company, then a large dividend is declared and shares sold at a less than market value (loss) to the former shareholders which then is used as a basis for tax refund claims.

Tax evasion involves a taxpayer’s deliberate contravention of the tax law(s) in order to minimize or eliminate tax liability altogether (pay no or little tax respectively by breaking the law). Tax evasion is the application of fraudulent practices in order to minimize or eliminate tax liability.

Where such acts are made with the intent to evade tax or assist another person to evade tax it constitutes fraud or gross neglect, which is heavily punishable by law.

A recent study conducted in association with experts at the Internal Revenue Service of the United States demonstrates that American taxpayers with earnings in the top 1% are far more skilled at tax evasion than the remaining 99 percent.

equitablegrowth.org

The following are the examples of tax evasion.

Generally, the effects of tax avoidance and tax evasion on the government and economy at large include non-realization of budget plans and national fiscal objectives due to loss of government revenue, Non-realization of other non-revenue goals of taxation, it will lead to alternative sources of government revenue e.g. foreign loans/grants which result in dependency.

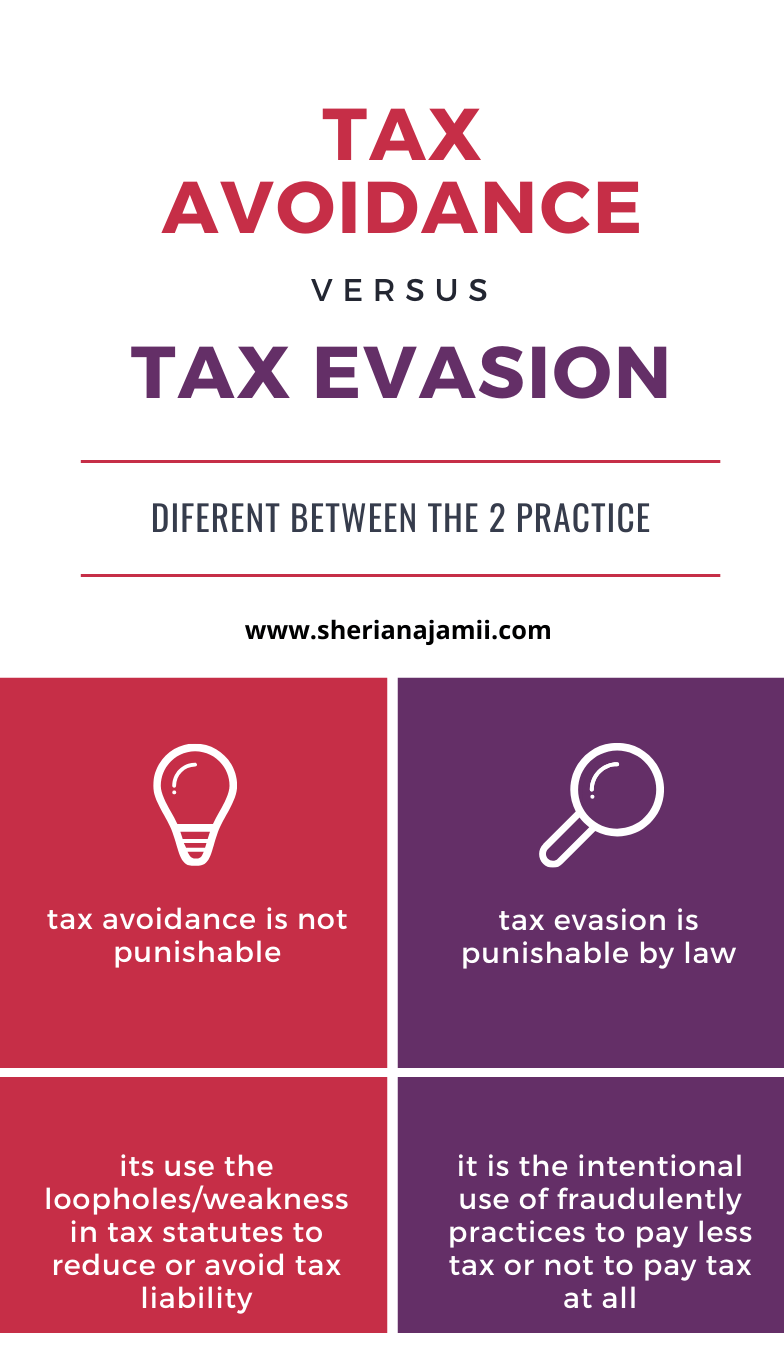

The major difference between tax avoidance and tax evasion is that tax avoidance is not punishable by law while tax evasion is punishable by law.

Tax avoidance uses the loopholes/weakness in tax statutes to reduce or avoid tax liability but tax evasion is the intentional use of fraudulently practices to pay less tax or not to pay tax at all.

These notes act as the ultimate guide on tax avoidance and tax evasion.

It covers the meaning and strategies of tax avoidance and tax evasion, causes of tax avoidance and tax evasion, the impact of tax avoidance and tax evasion, and the difference between tax avoidance and tax evasion.

Hope you will find that useful. Spread the knowledge by sharing this post.

References

Books

Makinyika F.D.A. L (2007) a sourcebook of income tax law in Tanzania, Dar es Salaam: University of Dar es salaam press

Mponguliana R.G. (2000) the Theory and Practice of Taxation in Tanzania, Dar es Salaam: NBAA